What Is Third Market? Which Means And Examples

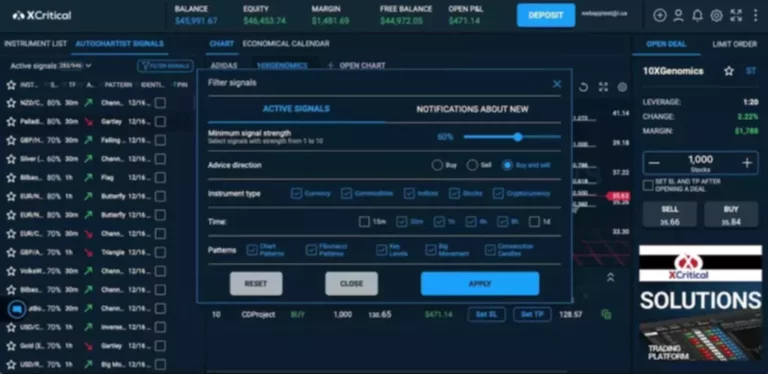

The algorithm aims to execute the order on the lowest attainable cost by analysing the charges of every venue and deciding on the venue with the lowest charge. Smart order routing (SOR) is an automatic buying and selling dark pool meaning technique used by institutional traders to make certain that orders are executed at the most effective available value throughout a quantity of markets or buying and selling venues. Instead of manually looking for the most effective value, SOR expertise uses algorithms to evaluate the value, liquidity, and order characteristics across totally different markets.

Exclusive: Should Not Sebi Officers Be Subject To The Identical Standards Of

Additionally, be happy to watch our Youtube video on Dark Pool levels right here.

Tips On How To Predict The Market Trend With The Coppock Curve: A Technical Evaluation Tool

A wide selection of exchange-listed securities, together with shares, bonds, and other monetary instruments, may be traded in the third market. The purpose of the third market is to facilitate the trading of exchange-listed securities outdoors of the standard secondary market, notably for large-scale transactions. If you’re an institutional investor looking to optimize your buying and selling strategy, explore the benefits of darkish swimming pools with the assistance of Stocksphi. Contact us at present to find out how we can help you obtain your trading goals. Stocksphi offers complete threat administration options, guaranteeing that purchasers can commerce confidently in darkish pools. Dark swimming pools provide unparalleled flexibility for executing varied trading methods.

Volume-weighted Common Price (vwap) Smart Order Route:

- Overall, the fee financial savings and anonymity supplied by the third market make it a most well-liked choice for institutional traders when conducting bulk trades.

- Before diving into sensible order routing, it’s essential to understand the concept of a “route” within the inventory market.

- Smart order route configurations discuss with the settings, preferences, and parameters that a dealer can customise throughout the sensible order routing system.

- If you’re on the lookout for anonymity or privateness in relation to your buying and selling activities and prospects, you’re most likely not going to be glad with any kind of anonymous buying and selling.

- On Quant Data, we sum all of the Dark Pool trades at every particular degree to create a dynamically updating list of the top ranges per timeframe you choose.

SOR makes use of algorithms to analyse market information, together with historic pricing information, present market circumstances, and real-time order book knowledge. Based on this information, the system selects the most environment friendly and cost-effective routes for every commerce, considering numerous factors such as velocity, cost, liquidity, and order size. After you purchase your shares, the BSE publishes a transaction list of shares.

30 Rights Concern: Penny Stock Under Rs 5 To Keep Beneath Radar As Company Signs Mou

Dark Pools are private exchanges that function exterior of the normal stock market, providing a way for institutional investors to commerce large blocks of securities away from public view. By maintaining these transactions hidden, dark swimming pools permit institutional investors to commerce massive blocks of securities without affecting the market value of the security. This is a significant advantage for investors who need to keep away from slippage orprotect their trading strategies from opponents. Think of it as a secret membership for institutional investors, like hedge funds and pension funds, to make big trades with out tipping off the market. By preserving their identities and the main points of their transactions hidden, darkish poolparticipants can keep away from slippage and defend their trading methods. As the monetary landscape continues to evolve, darkish swimming pools will play an increasingly important position in trade execution and market stability.

Premier Energies’ Promoters Sells 306% Of Problem To Pick Few Entities 5

In truth, darkish pools are legal and fully regulated by the Securities and Exchange Commission. Dark swimming pools enable traders to make block trades with out having to publicize the buy/sell price or the variety of shares traded to the common public. This means trades are done anonymously and don’t give clues to different traders. The lack of transparency can even work in opposition to a pool participant since there is not a assure that the institution’s trade was executed at one of the best worth. A surprisingly giant proportion of broker-dealer darkish pool trades are executed inside the pools–a process that is recognized as internalization, even when the broker-dealer has a small share of the united states market.

They symbolize the ideal inventory market as a result of they’re really transparent. When retail traders purchase and sell stocks and different securities, they normally go through a brokerage firm or their most popular on-line buying and selling platform. The rule would require brokerages to send client trades to exchanges somewhat than darkish pools until they can execute the trades at a meaningfully higher value than that obtainable within the public market.

During The Last 20 Years, Technology Has Had A Huge Impact On Monetary Markets

Several notable cases illustrate the efficacy of dark swimming pools in dealing with giant block transactions. For instance, a serious pension fund would possibly use a darkish pool to purchase a big stake in a blue-chip company without alerting the market, thereby avoiding a spike within the stock’s price. Risk tolerance determines the level of risk the trader is willing to take primarily based on market conditions.

Dark pools were created in order to facilitate block trading by institutional traders who did not want to impression the markets with their massive orders and procure adverse costs for his or her trades. The existence of third markets performs an important position within the trading and funding landscape. These markets allow the seamless buying and selling of huge blocks of company shares, facilitating environment friendly transactions for institutional traders. Without the presence of third markets, executing substantial trades in the secondary market may lead to elevated volatility and potential disruptions in stock costs.

Imagine what would happen if a Nike retailer owner tried to accommodate a wholesale purchaser inside a packed retail showroom by shouting to everybody that the next 15,000 pairs come at a 15% discount. Other customers could rush to the cash register first, the store may run out of footwear, and bulk consumers would go home disappointed. The third market is taken into account a negotiated market, as trades are conducted via direct negotiations and agreements between patrons, sellers, and certified market makers. Use the Impact Dashboard to establish and put money into companies that share your values, and use ESG scores from Refinitiv to make funding decisions primarily based on more than simply monetary components.

In this text, we’ll discover every thing you want to know about darkish pools, including their advantages, controversies, and role in the monetary markets. Whether you’re a seasoned investor or just starting out, understanding the insand outs of dark swimming pools can help you make informed decisions about your investments and navigate the complexities of the financial world. Stocksphi supplies tailor-made options to capitalize on these cost efficiencies, enhancing the overall return on funding for its clients. By using inside crossing and algorithms, dark swimming pools can supply better costs than these available in public markets, especially for large orders. At the identical time, because dark swimming pools essentially rely on public prices as a benchmark for their trades, and customarily underneath the U.S.

Read more about https://www.xcritical.in/ here.