Understanding an Income Statement Definition and Examples Bench Accounting

Along with balance sheets and cash flow statements, income statements are one of the three financial statements essential for measuring your company’s performance. It tracks the company’s revenue, expenses, gains, and losses during a set period. A common size income statement is an income statement in which each line item is represented as a percentage of sales or revenues generated by your business. Such an income statement helps to understand and compare the financial performance of the business entity over different accounting periods.

This is operating breaking your femur at rileys is potentially fatal income or EBIT before taking into account the unusual expense of $123 million. For example, a doctor derives operating revenue by providing medical treatment whereas a manufacturer of furniture generates operating revenue through sales of such furniture. The following are the steps to prepare an income statement for your business. After preparing the skeleton of an income statement as such, it can then be integrated into a proper financial model to forecast future performance. After deducting all the above expenses, we finally arrive at the first subtotal on the income statement, Operating Income (also known as EBIT or Earnings Before Interest and Taxes).

Examples of non-operating expenses include loss on the sale of fixed assets (where buying and selling such fixed assets is not a part of your core business activity). By carefully examining both total revenue and net sales, readers can gain valuable insights into a company’s financial health. This information, in turn, can guide future business decisions and strategies. An Income Statement is a financial statement that shows the revenues and expenses of a company over a specific accounting period. The above example is the simplest form of income statement that any standard business can generate. It is called the single-step income statement as it is based on a simple calculation that sums up revenue and gains and subtracts expenses and losses.

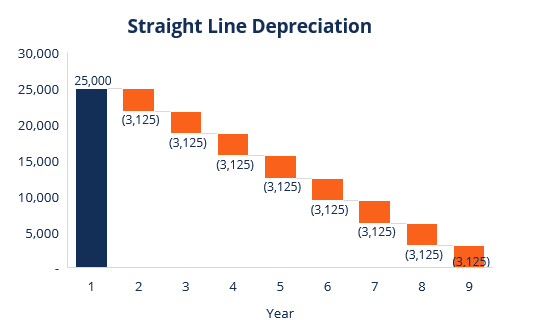

Cost of goods sold

Common size income statements include an additional column of data summarizing each line item as a percentage of your total revenue. Small businesses typically start producing income statements when a bank or investor wants to review the financial performance of their business to see how profitable they are. When used in conjunction with the other financial statements, an income statement can give you a clear view of your cash flow. In addition to this, there are various sections in the income statement that can help the users of such a statement understand how revenue generated from sales is transformed into net income or a net loss. For instance, the gross profit helps the management to set the retail price of a product or service, considering the prices offered by competitors.

The bookkeeping for owner-operator truck drivers balance sheet tells you where you are, while the income statement tells you how you got there. It shows you how much money flowed into and out of your business over a certain period of time. If your business owes someone money, it probably has to make monthly interest payments. Your interest expenses are the total interest payments your business made to its creditors for the period covered by the income statement.

What are Common Drivers for Each Income Statement Item?

Non-operating revenue is the part of your revenue that is produced from secondary activities, such as activities that do not form part of your core business operations. Operating revenue is the revenue that your business generates from its primary or core business activities. What constitutes an operating revenue varies depending on the type of business as well as the industry your business is in. These are further categorised into operating and non-operating revenues from other sources.

Producing a Trial Balance Report

In response to the second weakness, accountants gather and report information about the effects of the various types of changes in owners’ equity throughout the year. Firstly, instead of focusing on changes in wealth, accounting income represents changes in owners’ equity (except for contributions from the value of tax shields is not equal to the present value of tax shields and distributions to owners). Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- The balance sheet consists of assets, liabilities, and owners’ equity, revealing what the company owns, what it owes, and the equity owned by shareholders.

- But multi-step income statements are great for small businesses with several income streams.

- In the accrual basis of accounting, revenues are recognized when goods are delivered or services are provided regardless of when the company will receive the payment.

- The second item involves determining the income or loss earned through operating the discontinued segment from the beginning of the fiscal year up to the date that the decision to discontinue is finalized.

- The first step in preparing an income statement for your business is to select the accounting period for which you need to prepare the income statement.

- As the name suggests, it is a single-step income statement that includes one subtraction, that is, subtracting the sum of expenses and losses from the sum of revenues and gains.

Accountants and financial analysts usually prefer to look at your operating income—rather than your net income—to determine how profitable your company is. The income statement should be used in tandem with the balance sheet and cash flow statement. With insights from all three of these financial reports, you can make informed decisions about how best to grow your business. Non-operating expenses are the expenses that are incurred by your business but are not related to your core business operations.

In addition to this, it also showcases the operational performance of your business over a certain accounting period. An Income Statement is a statement of operations that captures a summary of the performance of your business within a given accounting period. It reveals your business’s revenues, costs, Gross Profit, Selling and Administrative Expenses, taxes, and Net Profit in a standardised format. For example, if revenues and gains are worth $215,000, and Expenses and Losses are worth $77,000, the Net Income turns out to be $138,000. The multi-step income statement categorises revenues, gains, expenses, and losses into operating and non-operating items.

Income From Continuing Operations

These are all expenses that go toward a loss-making sale of long-term assets, one-time or any other unusual costs, or expenses toward lawsuits. A business’s cost to continue operating and turning a profit is known as an expense. Some of these expenses may be written off on a tax return if they meet Internal Revenue Service (IRS) guidelines. Payment is usually accounted for in the period when sales are made or services are delivered. Receipts are the cash received and are accounted for when the money is received. We’ll take you step-by-step through the Bench income statement and how it describes the current financial state of your company.